Treasury Yield Volatility a New Headwind to CRE Deal Flow

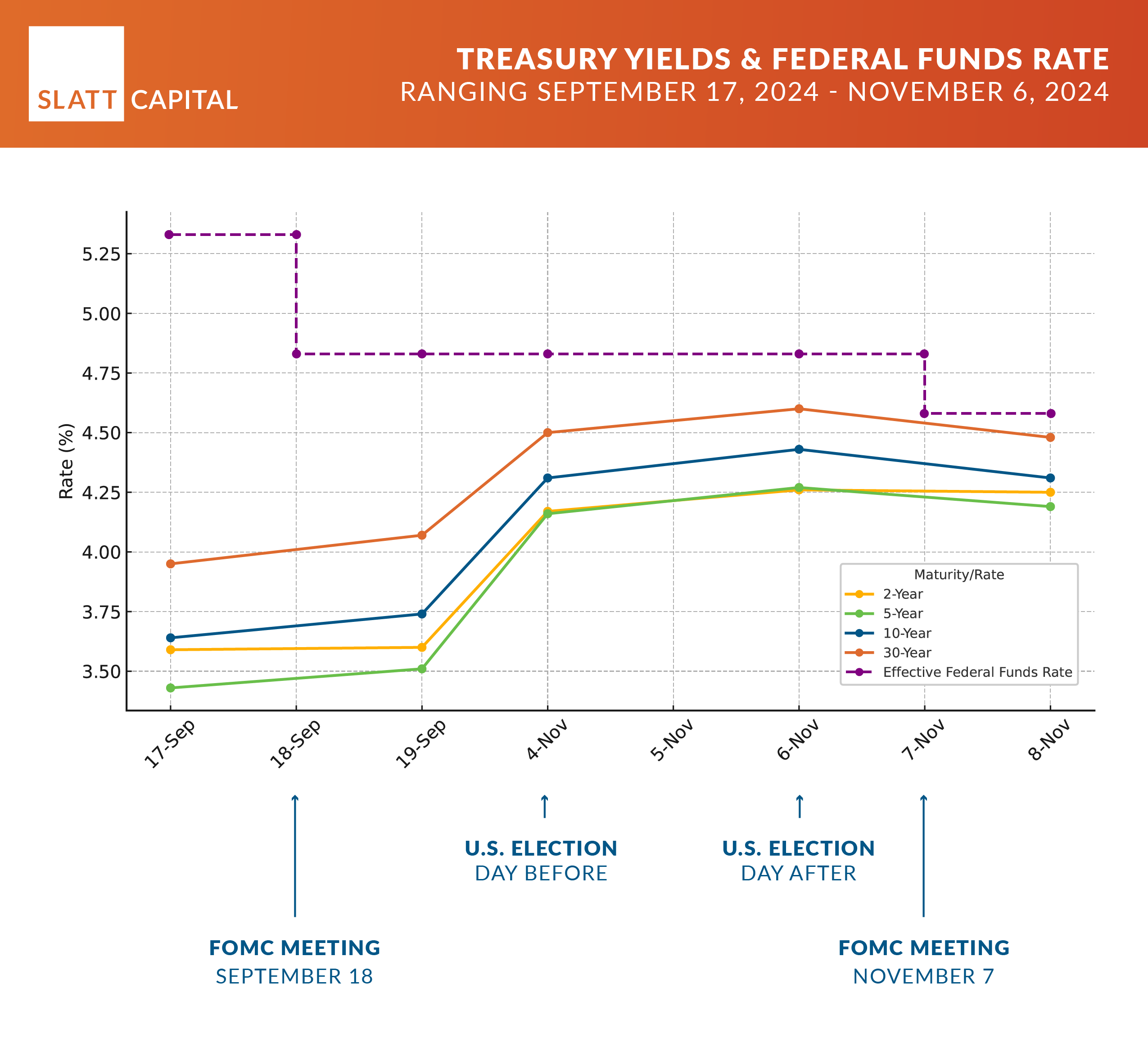

The recent, yet unexpected, rise in the U.S. 10-year Treasury yield has created a new headwind to improved commercial real estate deal flow. The Federal Reserve’s most recent decision to lower the Federal Funds rate by 25 basis points in November, was intended to continue to fight inflation and provide additional stimulus to the U.S. economy, but subsequently, a swing in the 10-year Treasury yield has presented significant implications for the commercial real estate market.

The relationship between short- and long-term interest rates is a dynamic that must be understood. The Fed’s primary tool for influencing economic activity is the Federal Funds rate, which directly impacts short-term borrowing costs. By lowering this rate, the Fed aims to encourage borrowing and spending, thereby stimulating economic growth.

However, the 10-year Treasury yield is influenced by a broader range of factors, including inflation expectations, economic growth projections, and global demand for U.S. debt. When the Fed lowers short-term rates, investors may perceive it as a sign of potential future inflation. As inflation rises, the value of fixed-income investments like Treasury bonds diminishes. To compensate for this risk, investors demand higher yields on longer-term bonds, pushing the 10-year Treasury yield upward. Prior to the first Fed rate cut in September, the 10-Year Treasury yield stood at 3.64%, and by early November, after another rate cut and U.S. election, it had jumped to 4.31%.

The rise in the 10-year Treasury yield has a direct impact on commercial real estate, particularly as developers and investors rely on long-term debt financing and are facing higher borrowing costs compared to early 2024. As the 10-year Treasury yield rises, the cost of borrowing increases, making it more expensive to acquire or develop properties, and making it more difficult to pencil exits, particularly on new construction.

The expectation was that capital and investors would come off the sidelines this fall as the Fed began to drop rates, but the timing coincided with the rising 10-year rate, and investors adopted a “wait and see” approach leading up to the election. Now with the election in the rear-view mirror, reasons against deploying capital are beginning to diminish. But the increase in long-term rates doesn’t yet provide the confidence investors and developers need to move forward. Additionally, the rise in long-term rates has served as a drag to deal flow that is overshadowing the optimism the short-term rate drop created.