September Interest Rate Update

September 15, 2022

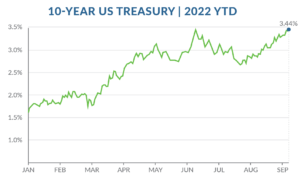

The U.S Bureau of Labor Statistics (BLS) announced on Tuesday, September 13th, that the consumer price index rose 0.1% in August on a seasonally adjusted basis after being unchanged in July. Over the last 12 months, the all items index increased 8.3%. This increase was marginally higher than anticipated and has caused volatility and upward movement in the benchmark 10-year treasury. The 10-year treasury reached 3.44% at the close of the market today, close to the year’s peak of 3.48% reached on June 13th. It is interesting to put rates in perspective by looking at the charts below:

The current market for fixed-rate loans looks like the following

- 3-year fixed from 4.75-5.75%

- 5-year fixed from 5.00-6.00%

- 10-year fixed from 5.00-6.00%