Market Volatility and Loans

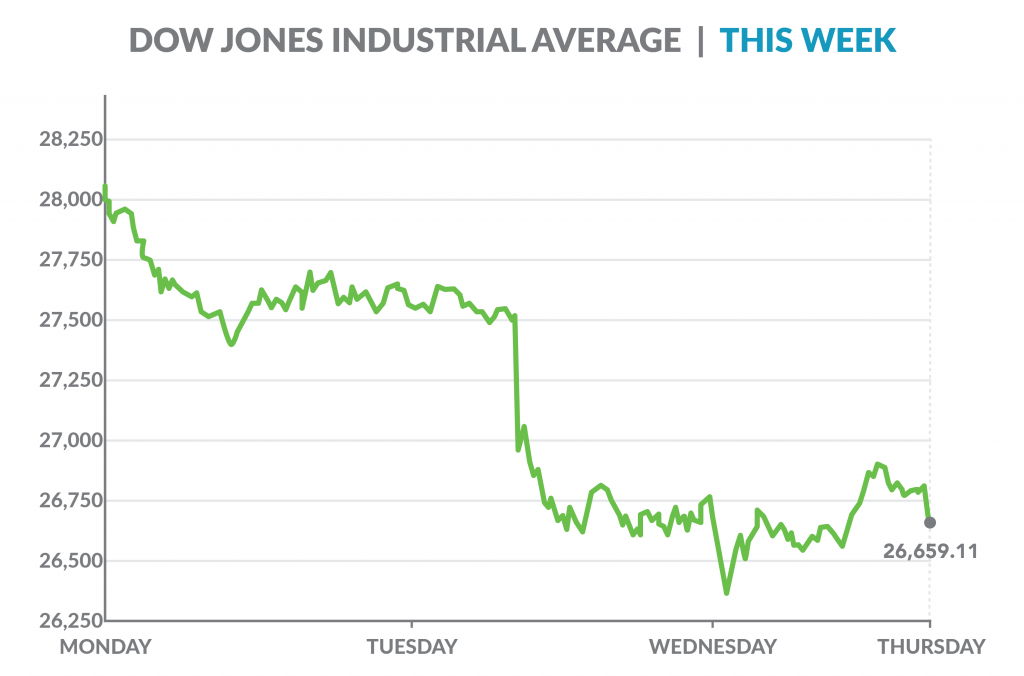

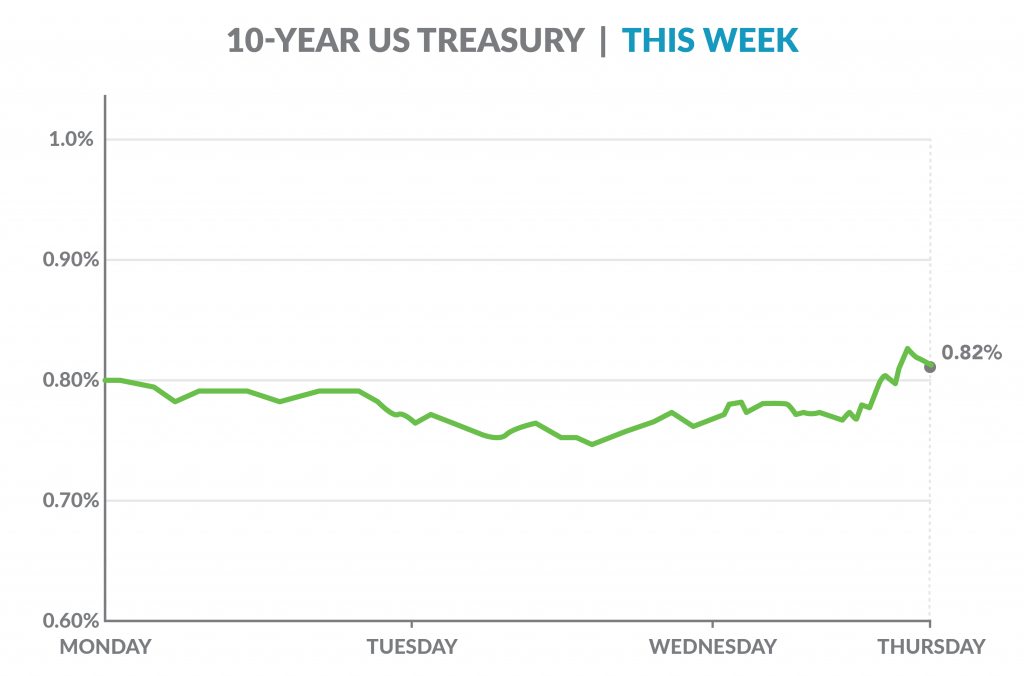

The financial markets have been quite volatile this week with the Dow Jones average dropping over 1,600 points between Monday, Tuesday, and Wednesday with a 139.16 bounce today. A rally in bond yields has taken hold this week with the 10-year treasury rate closing today at 0.82% down from 0.86% last week and 1.85% last year. Investors tend to buy “safe haven” treasuries when the stock market sells off. According to a 10/28/2020 article in CNN Business written by Matt Egan, “Coronavirus infections are surging in the United States and much worse in Europe. Investors are suddenly spooked.” The uncertainty caused by the upcoming election has also added to the volatility.

Amidst this market volatility, the commerce department announced today that the United States economy bounced back in the second quarter of the year. Gross Domestic Product (GDP) grew 7.4% from the prior period., a quarterly gain that equals an annualized pace of 33.1%. According to an article on 10/29/2020 in Bloomberg by Reade Pickert, “while the report makes clear that the economy has found a solid footing for now, analysts caution that growth will be much more modest and choppy in the months to come…”

What does market volatility mean for the loan markets?

In the short run, market volatility has not changed the appetite of the loan markets. Interest rates remain at all-time lows and lenders need to invest in commercial and multi-family loans. Lenders look at investing in loans through volatility with a cautious eye, so expect them to take a cautious approach.

In the long run, lenders will examine longer-term market trends and take those into account when making decisions on what loans they should make and how to underwrite around risk.

Dan Friedeberg

CEO

danf@slatt.com

Connect on LinkedIn