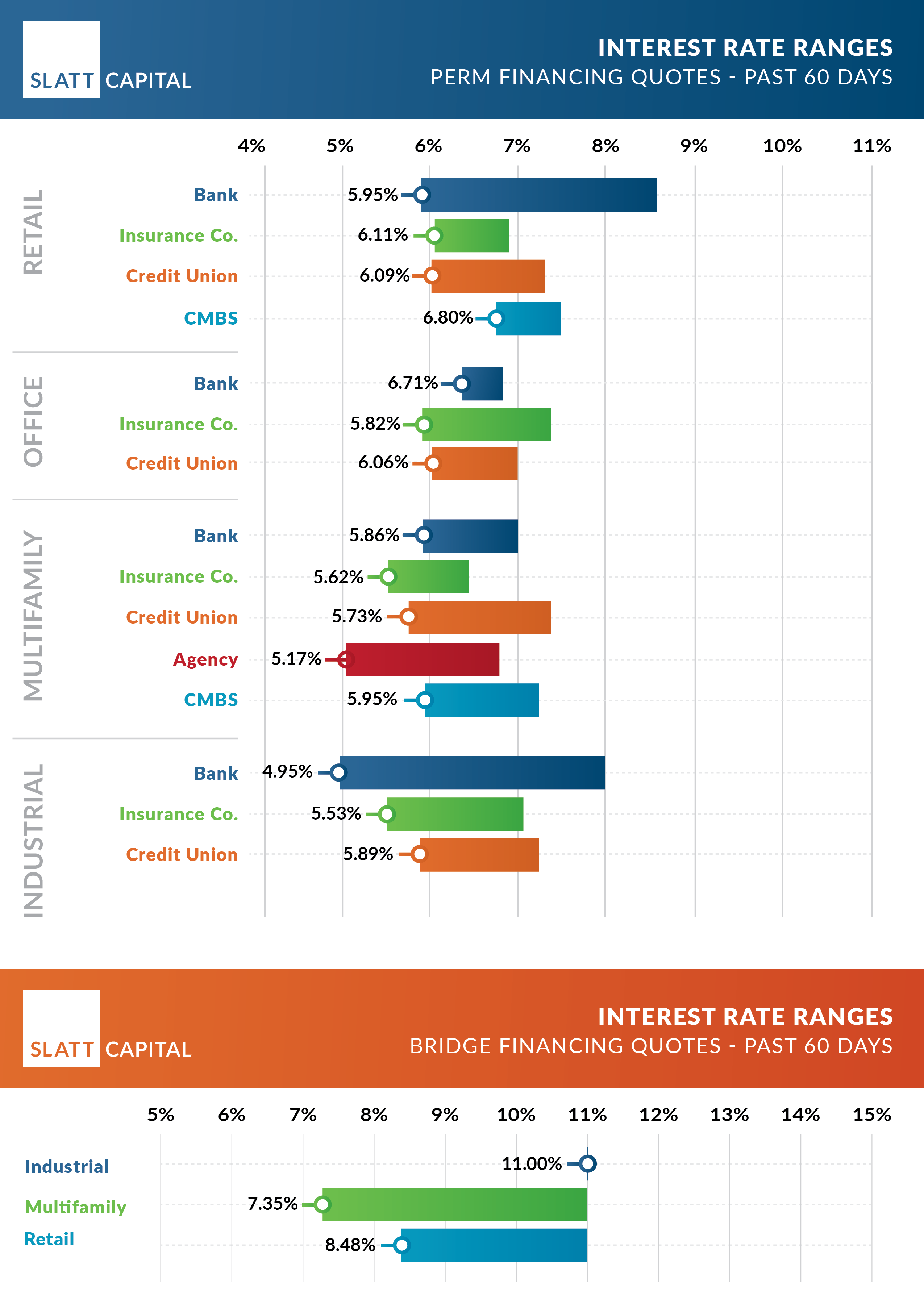

March 2025 Interest Rate Ranges: Quoted Past 60 Days

With an unpredictable Q1 nearly behind us, we have seen overall rates come down resulting in a welcomed increase in activity across most of the lending community. Life Company, CMBS, and Agency lender origination continue to be strong as all-in rates have fallen, even with a little widening of spreads over the last week or more. Banks and Credit Unions continue to pick up market share as their cost of capital has come down and demand for flexible, shorter capital continues to be at the forefront of most borrowers.

On the other hand, Debt Fund and Private Capital lenders have not seen a contraction in rates overall but continue to be major players in the volatile market, where borrowers are seeking shorter-term, higher leverage, and more flexible terms to address construction needs, loan maturities, and restructuring of existing debt.

Stay tuned for more of the same as we expect rates to be volatile over the next 60-90 days as there is no real clarity on how the economy and greater investment markets will react to the geopolitical challenges that seem to be coming from all directions. For more specific data points, here is a snapshot of rates over the past 30-60-90 days per product and lender type.

Slatt Capital aims to offer a clear overview of the interest rate ranges quoted for various types of commercial real estate properties and lenders. This data is derived from financing quotes from all Slatt Capital offices within the past 60 days.

Previous Average Interest Rate Quotes:

February 2025

January 2025

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024

May 2024

April 2024

March 2024

February 2024

January 2024