Macro Near-Term Interpretation of the Fed’s Rate Increases

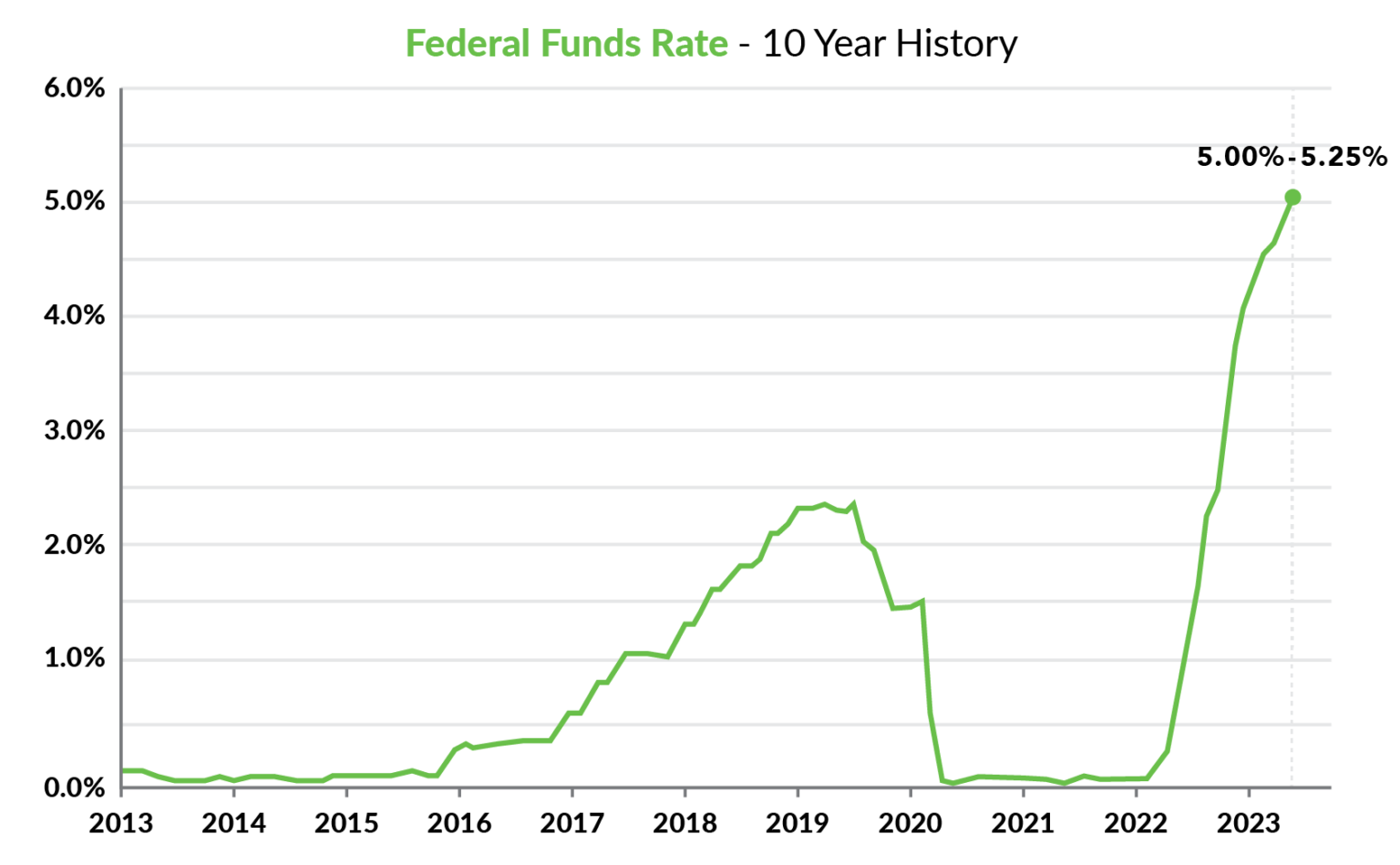

Are we looking at a momentary pause in the federal fund rate hikes in June following an aggressive climb over the last 18 months?

The Federal Funds Rate is the interest rate at which depository institutions (such as banks) lend funds to each other overnight in the United States. It is set by the Federal Open Market Committee (FOMC), which is the monetary policy-making body of the Federal Reserve System.

When the Federal Funds Rate is lowered, it becomes cheaper for banks to borrow money, leading to increased lending and economic activity. This can stimulate economic growth and investment. Conversely, when the Federal Funds Rate is raised, it becomes more expensive for banks to borrow, which can help cool down an overheating economy or control inflation.

“All the pieces of a skip are here and told more forcefully than in past weeks,” Tim Duy, chief U.S. economist at SGH Macro Advisors. – AP News

The Fed has increased the funds effective rate in 10 of the past 12 opportunities. One year ago this base rate sat near 0.83%, today we are above 5%. Fed Chair Jerome Powell has indicated that there are no signs of pulling back the throttle. According to many leading economists, we could see a pause this month on rate increases. The Bureau of Labor Statistics’s (BLS) May employment report states that the unemployment rate rose by 0.3 percentage points to 3.7 percent. The unemployment rate is one indication of many that the FOMC watches carefully to slow spending, cool the economy, and bring down inflation.

All eyes and ears of the market will be focused on Jerome Powell on June 13th and 14th for signs of the Fed’s plan moving into the second half of 2023.

If you are curious to learn more about the market and have questions about where commercial mortgage rates are today. Contact your trusted Slatt Capital commercial mortgage banker.

Parker Watson

Associate

D: 415.423.1730

parker.watson@slatt.com