June Interest Rate Update

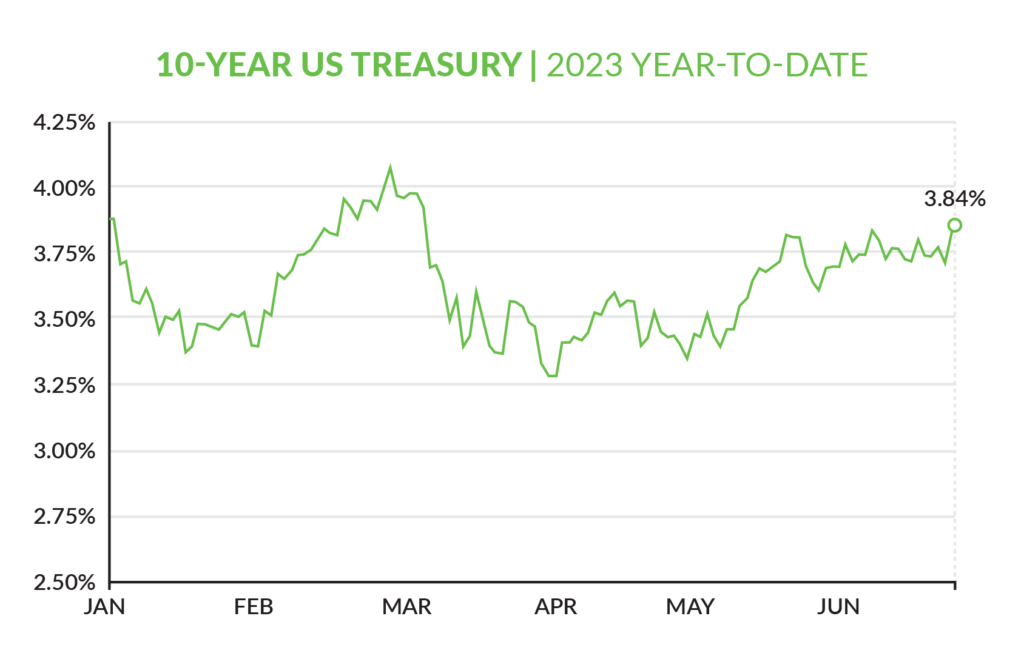

The yield on the 10-year Treasury (US10Y) rose 13 basis points to 3.838% today following an announcement that the US gross domestic product rose more than originally forecasted. The common feeling is the news indicates that the U.S. economy may be farther from a recession than originally feared. A reduced number of jobless claims from April to May added to the positive economic sentiment.

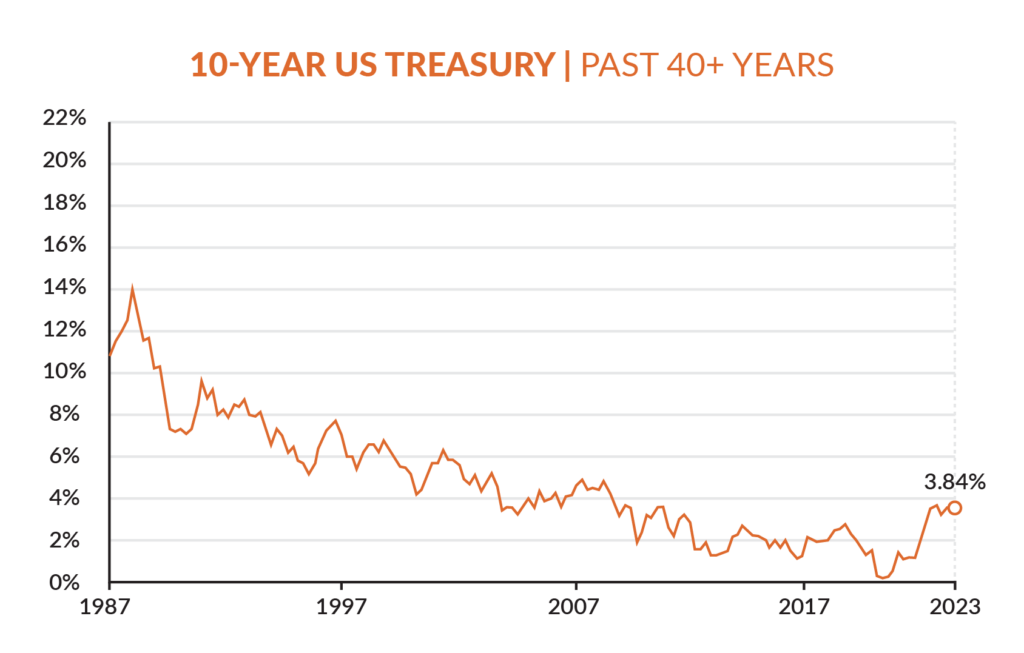

Although the US10Y has risen steadily since early April, it is still .25% off of 2023’s high of 4.09% seen in early March, and relatively low from a historical standpoint.

Tomorrow signifies the close of the first half of the calendar year and opens the door to a second half ripe with uncertainty. The overall market will continue to monitor potential future rate hikes by the Fed and also eagerly track whether or not inflation continues its recent decline.

Enjoy a hamburger, hot dog, and fireworks with the family over the 4th of July weekend, and ready yourself for what should be an active second half to 2023.