June 2022 Interest Rate Update

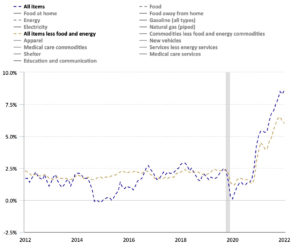

The Consumer Price Index (CPI) dropped from 8.5% in March to 8.3% in April only to bounce back to 8.6% in May. The 8.6% 12-month increase ending May is the largest 12-month increase since December 1981. Much of that was driven by the extreme increase in the energy category as the core CPI (CPI without the food and energy components) dropped from 6.2% to 6.0%. June’s CPI data is expected to be released on July 13th. Optimistic eyes with be seeking a decrease in the year-over-year percentage now that the Fed’s aggressive rate hike plan to reduce inflation is in full motion.

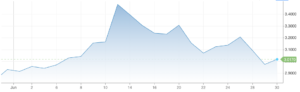

Since climbing to an annual peak of 3.48% on June 13th the benchmark 10-year treasury has settled back down to 3.01% to end the month of June.

Rates are still low from a historical standpoint. This becomes transparent when reviewing the charts below. The current market for fixed-rate loans looks like the following:

- 3-year fixed from 4.00-5.00%

- 5-year fixed from 4.375-5.75%

- 10-year fixed from 4.375-5.75%

- 15-year fixed from 4.25-5.75%

- 20-year fixed from 4.50-5.75%

Source: U.S. Bureau of Labor Statistics

Source: CNBC