Are Fannie and Freddie the Right Choice for Your Multifamily Debt?

According to the Mortgage Bankers Association, agencies Freddie Mac (Federal Home Loan Mortgage Corporation or FHLMC) and Fannie Mae (Federal National Mortgage Association or FNMA) held a combined 38% share of the multifamily lending market in 2019. These multifamily lenders may use interest-only options and loan amounts up to 75-80% LTV to appeal to borrowers. Rates are at historic lows with non-recourse, fixed-rate terms from five to 30 years. Low-cost, small balance Freddie and Fannie programs are available for deals under $7M, and they can lend in secondary and tertiary markets. Sounds like a no-brainer, right?

A common belief is that since Freddie and Fannie are the most prolific sources of debt for apartment buildings, they will always be a superior and safer choice than other sources including banks, commercial mortgage-backed securitizations, and life insurers. Understanding the nuances and intricacies of the entire multifamily lending landscape is a complex undertaking, and results can vary dramatically from lender to lender.

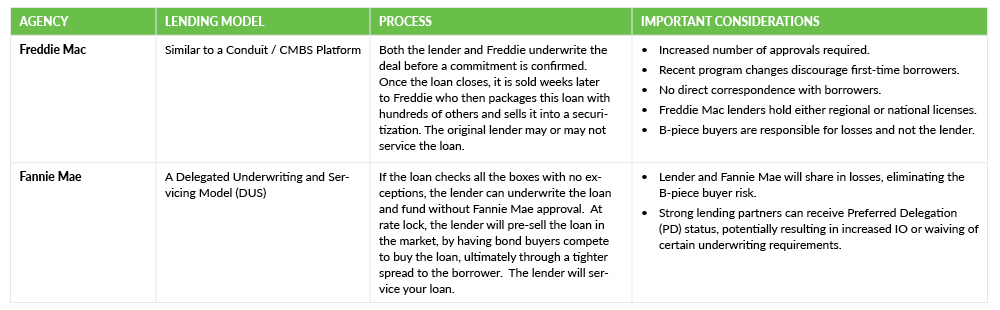

How do Freddie Mac and Fannie Mae Compare?

While Freddie and Fannie have firmly cemented their reputations as the largest multifamily lenders, that doesn’t always mean they are the right lenders for your deal. Let’s examine some key differences and what they mean to the borrower.

How can I navigate the myriad choices?

Engaging an experienced mortgage banker is the first step to ensuring you have all the necessary tools, information, and resources you need to make an informed decision. What will you gain?

Knowledge. A qualified mortgage banker has access to critical information not provided by Freddie Mac or Fannie Mae. This could include such things as which lenders will be best for a deal in Houston or Oklahoma or a number of other select nationwide markets on a pre-review Freddie Mac list that will be subject to more conservative underwriting. Trying to get a mezzanine loan behind your Fannie Mae senior? Most people don’t know there are actually a handful of select Fannie lenders that will put a mezzanine loan behind the Fannie loan they originate, underwriting the mezzanine loan to a 1.1x DSCR and up to 85% LTV.

Communication. Freddie Mac doesn’t correspond directly with its ultimate borrowers, so most borrowers don’t know when programmatic changes happen that could materially affect a loan. In a recent example, Freddie SBL changed its program requirements to now state that an eligible borrower that does not own at least three multifamily properties would have to own at least one apartment building for more than five years to qualify as a Freddie Mac SBL borrower. Of course there are always exceptions given, but it is important to know which lender is equipped to navigate that process.

Guidance. Programs are changing almost weekly now and staying educated on the finer details can seem like an impossible, and not advisable, task. There are many complicated nuances to the process, and a qualified mortgage banker can help break through the noise.

Looking Forward for Multifamily

In a recent article in Multifamily Executive magazine, Mortgage Bankers Association Vice President of Commercial Real Estate Research Jamie Woodwell acknowledged the 2020 multifamily deal decline due to COVID-19, but stated “The multifamily sector has held up quite well so far, with federal government stimulus efforts for the unemployed helping renters make their rent payments.” He added, “Forecasting amidst the social and economic responses to the virus is difficult, but we do expect originations to drop significantly this year before making a sharp, partial rebound in 2021.” Freddie Mac estimated that multifamily loan originations will fall 20-40% in 2020, with the final outcome largely dependent on economic recovery and how well the virus is contained.

For borrowers considering Freddie and Fannie, it is important to know that agency lenders’ reserves are still in a state of flux. Most moderate-to-higher LTV (60% – 75%) borrower requests will have six to 12 months required debt service reserves, while sub-60% will be faced with less severe or no reserve requirements.

About the Author:

John Darrow is a senior vice president with Slatt Capital. He is a commercial real estate professional with more than 15 years in the industry, and a range of experience from agency banking to distressed debt investing. He closed more than 450 Fannie Mae and Freddie Mac loans between 2015 and 2020, and has been ranked as a top originator for Freddie SBL loans in Texas multiple times.

D: 949.335.7821

M: 212.390.1884

john.darrow@slatt.com

Connect with John on LinkedIn