Conflicting Economic Signals

Three important monthly data points were released Thursday morning: the Consumer Price Index (CPI), industrial production figures and the National Association of Home Builders’ Housing Market Index (HMI). Unfortunately for those trying to gauge U.S. economic health, the reports gave conflicting signals: CPI stabilized at 2 percent year-over-year growth (a good thing); industrial production fell 0.6 percent, but that might be because of some weird weather (neutral); and the HMI fell to a one-year low (bad).

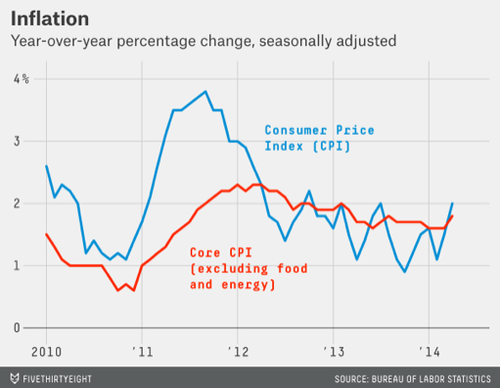

Inflation data for April showed consumer prices rising 0.3 percent compared to March, and 2 percent from a year ago—the first time it has hit that level since July of last year. The less volatile “core” CPI index (which excludes food and energy prices) also rose a bit to 1.8 percent year-over-year growth.

Economists and policymakers at the Federal Reserve have grown concerned about persistently low inflation, seeing it as a sign of economic weakness. These latest CPI numbers, however, should provide support for the Fed’s continued “tapering” of bond purchases—and further expedite the “renormalization” of monetary policy.

That is, unless the broader economy begins to weaken, as the other data released Thursday morning may indicate.