CMBS For Your Multifamily Refinance; Why Not?

I recently worked with a client who had a stabilized multifamily property that was a bit over-levered on a bridge loan and was coming to maturity. Unsurprisingly, proceeds were the most critical factor as we struggled to get to the loan amount to pay off the bridge lender. After clearing the market, we were both surprised to find that one of our correspondent CMBS shops beat out everyone else, including Fannie and Freddie. Everything about the deal was great until I mentioned CMBS, and then the “Ughh” came out of my client’s mouth. Hence, the background for this article was formed.

The most significant change for those not around the CMBS world in the last few years is that they have gotten some traction with their 5-year fixed rate term. Always one of the largest detractions was that no one really wanted 10-year fixed rate paper with a prepayment penalty for that long. Well, that has changed a lot in the last few years, and the 5-year option is prevalent and pricing decently well.

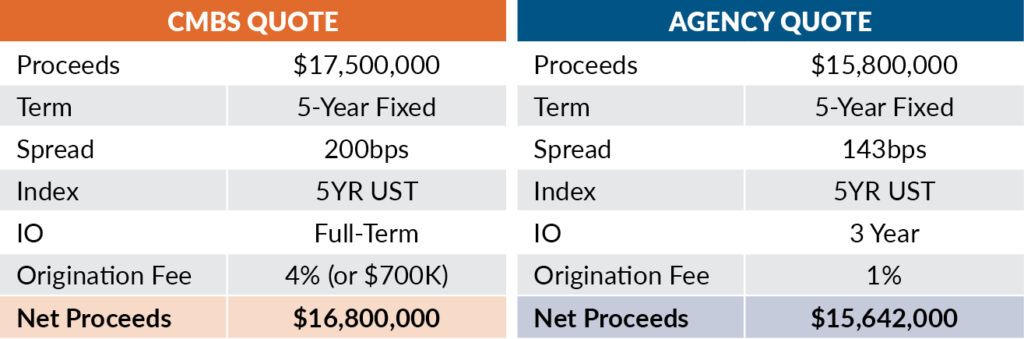

So, I decided to run another Class C Houston deal through the traps, sending it to our agency correspondent and a CMBS counterpart. CMBS is underwriting to as low as a 1.25 DSCR on an IO schedule, which equates to a 1.07 DSCR on a 30-year amortization schedule (On a side note, for class A multifamily, they are underwriting as low as a 1.20 DSCR on an IO schedule, or 1.02 on a 30YR amortization schedule). Off the rack, pricing is roughly 300bps over the 5YR UST for CMBS. However, they are aggressively buying down the spread with something known as a rate buydown. What that means on a 5-year term is for every 1% on the front end paid in an origination fee, the spread is 25bps lower, so a 4% origination fee, your loan would price 200bps over the 5-year UST, not 300bps over as was quoted initially. Here is how the math lays out:

$1.16M more in proceeds is a pretty big difference. Yes, your rate is higher, but you are full-term IO, so your cash flow, or CoC to your investors, should still be strong.

What about the loan covenants, representations, and warranties? I spent some time reading through the loan documents on a previous CMBS loan and on both Fannie Mae and Freddie Mac loans (you can pull down their boilerplate loan documents from the web if you ever want some light bedtime reading). In summary, many significant representations and warranties are generally the same, with some nuanced differences, but nothing that, in my head, is a stand-out deal killer. In the CMBS world, cash management is different from the agency world; however, most multifamily CMBS loans waive the establishment of the lockbox up front, and it only comes into play if there is an event of default (EOD). Maybe that moves the needle a bit, but you need to ask yourself, if you are forgoing $1.16M more in proceeds because you are focusing on what happens when you default, maybe you are focusing on the wrong thing. Defeasance is the next objection I get. Most people don’t understand the difference between that and yield maintenance. Still, it doesn’t necessarily matter anymore, as most CMBS shops will offer yield maintenance options for the same price.

And to be entirely honest, Freddie Mac and CMBS are pretty much the same—both a conduit execution, where loans are securitized and sold to investors. The most significant difference is the government is selling the Freddie loans, versus a bank with CMBS. Because taxpayers will ultimately shoulder any losses from Freddie Mac, they can offer better pricing. Fannie Mae is a bit different in terms of their loss share provisions.

As with anything, my intention in writing this article is primarily to offer another option and perspective to our current and potential clients. It is nice to have options again in the market when it comes to multifamily, and I would argue now more than ever that CMBS should be considered whenever agency is being considered.

Please reach out for further discussion or any questions about this topic.

John Darrow

Principal

john.darrow@slatt.com