A Case For Yield Maintenance

It is a basic requirement of our business that we very often are tasked with helping our Sponsor clients compare various loan options. One of the most important aspects of a given loan structure, and one that can frustrate even the most seasoned of borrowers, is comparing loans on the basis of prepayment terms.

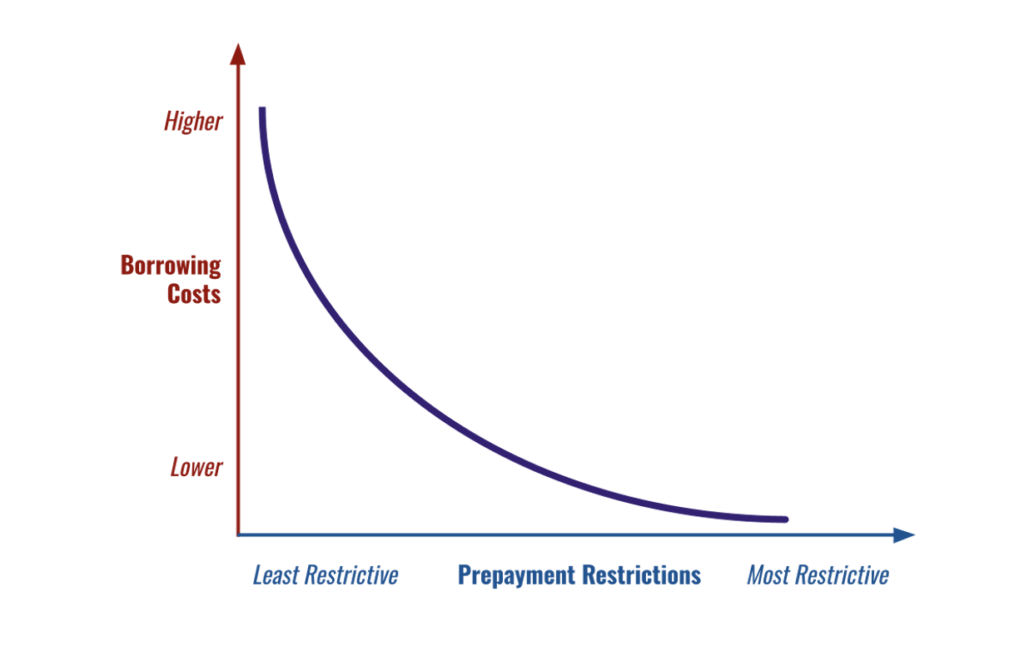

A comparison can often come down to a loan option with a lower interest rate and fees but a Yield Maintenance prepayment penalty vs. an option with a higher interest rate and/or fees but one with more prepayment flexibility. This makes sense since (all things equal) the more a lender allows prepayment flexibility, the more they’ll have to charge higher fees and interest rates to compensate them for the potential that the loan investment doesn’t continue to term…

This post aims to help us all work through the common thought processes a Sponsor and a mortgage professional should consider when weighing the options and hopefully aid in your next Yield Maintenance conversation.

First, what factors are important to consider when weighing prepayment options? The Sponsor should consider the following questions;

- What are the goals of a particular investment?

- How long will it take for the Sponsor to realistically achieve these goals?

- Is the Sponsor planning to sell the asset within 2-3 years? How about 5-7 years? Never?

- Is a possible sale tied to market conditions? Tenancy changes? Improvements to the property?

- What are the probabilities that any of these conditions will occur? What if an unexpected event occurs (such as a sudden death of a business partner, an above-market offer, or other)?

- What is the premium being charged on interest rate, fees, or other terms for some additional degree of prepayment flexibility?

- Are there other factors, such as interest-only terms, post-closing loan service, or certainty of execution that ought to be considered?

- What are the likely refinancing terms that will be available at the end of the target hold period?

- What are the potential costs to perform a refinancing in the future (including loan fees, 3rd party report fees, legal fees, title/escrow fees, etc)?

Often, we find that if we run a few likely scenarios, we find it can be often hard to justify paying a higher interest rate and higher fees today for the possibility of a lower interest rate tomorrow. This is primarily because a future refinance can cause an investment proforma to fail to break even on the additional interest paid during the initial hold period and the additional fees at the refinance and it can be challenging to recoup those costs even at drastically lower modeled interest rates.

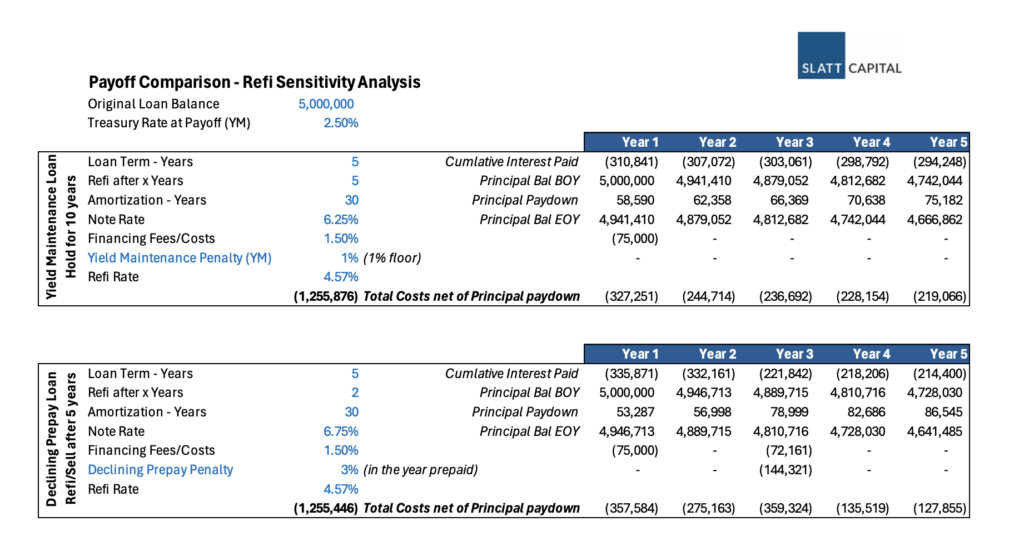

Let’s take a look at an example from a recent 5-year loan analysis. Below you’ll find a comparison in total costs given two basic scenarios:

Scenario 1 is where a Sponsor opts to take a lower interest rate today in exchange for a much more restrictive prepayment and therefore is more likely to hold the asset for the full 5- year term.

Scenario 2 is where a Sponsor opts to take a higher rate loan today with a typical 5-4-3-2-1% declining prepay and opts to prepay it starting after year 2. At the beginning of year 3, we model a refinance including an estimate of refinance costs and a lower interest rate.

What we find in this example is that the breakeven point of the 3% prepayment penalty and the additional refinance financing fees and costs occurs when the rate on the refinance goes down by more than 2.30% down from a 6.75% interest rate to a 4.57% interest rate in just over two years. And, the benefit of that lower rate is only fully-realized if held for years 4 and 5. We find that this concept is even more true when running longer analyses over 7-year, 10-year, or longer loan terms.

To wrap this all together, a comparison between loan options with Yield Maintenance and those offering more prepayment flexibility often requires a very nuanced understanding of the investment goals, potential future market conditions, and refinancing considerations. The example presented underscores the significance of conducting thorough analyses to evaluate the trade-offs between more prepayment flexibility and future refinancing expenses. As demonstrated, the breakeven point often lies beyond immediate projections, highlighting the need for a long-term perspective and strategic planning. By navigating these complexities with diligence, Sponsors and mortgage professionals can make informed decisions that align with investment objectives and maximize returns over the long term.