Interest Rate Update

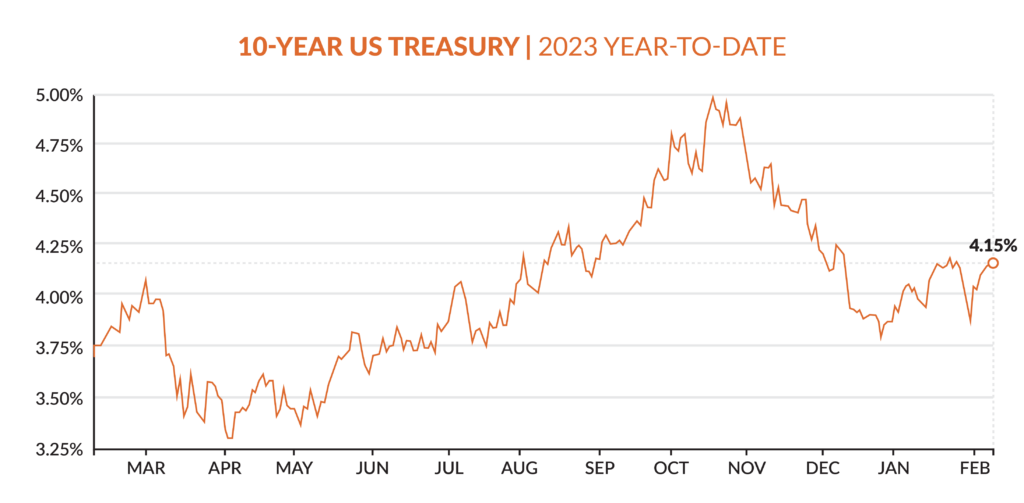

The benchmark 10-year U.S. Treasury Yield (US10Y) rose 6 basis points to reach 4.15% Wednesday, February 8. The move upward—after dropping to 3.86% to end the month of January—is potentially a reaction to positive American employment statistics being released showing lower-than-expected unemployment insurance filings to start February. The economic news adds strength to those forecasting that the Fed will take its time with rate cuts in 2024.

“With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully,” Federal Reserve Chair Jerome Powell commented in New Magazine.

Despite the bounce back this week, the US10Y is still oscillating around a whole percentage point off of its high of 4.99% in late October to 2023. January’s consumer price index report will be the next economic release to keep an eye on as the markets try to continue to predict the Fed’s next move.

The current market for fixed-rate loans looks like the following:

- 3-year fixed from 5.75-7.00%

- 5-year fixed from 5.50-7.00%

- 10-year fixed from 5.50-7.25%

- 15-year fixed from 6.00-7.00%

- 20-year fixed from 6.00-7.00%