Overview

Our team of experienced commercial mortgage banking advisors has a deep understanding of the commercial real estate market and the various types of mortgage products available. We work closely with our clients to identify their needs and objectives and then develop customized financing solutions that meet their specific requirements.

Our goal is to provide comprehensive support to our clients throughout the entire process, from initial consultation to loan closing and beyond.

At Slatt Capital, we pride ourselves on our ability to represent the interests of our clients and secure the best possible financing terms for them and their properties. We understand that every real estate project is unique, and we approach each one with a fresh perspective and a focus on delivering results.

Whether you are a seasoned commercial property owner or a first-time investor, our team of commercial mortgage banking advisors is here to help. Contact us today to schedule a consultation and learn more about how we can assist you in achieving your real estate investment goals.

Meet Our Commercial Mortgage Bankers

Correspondent Capital Sources

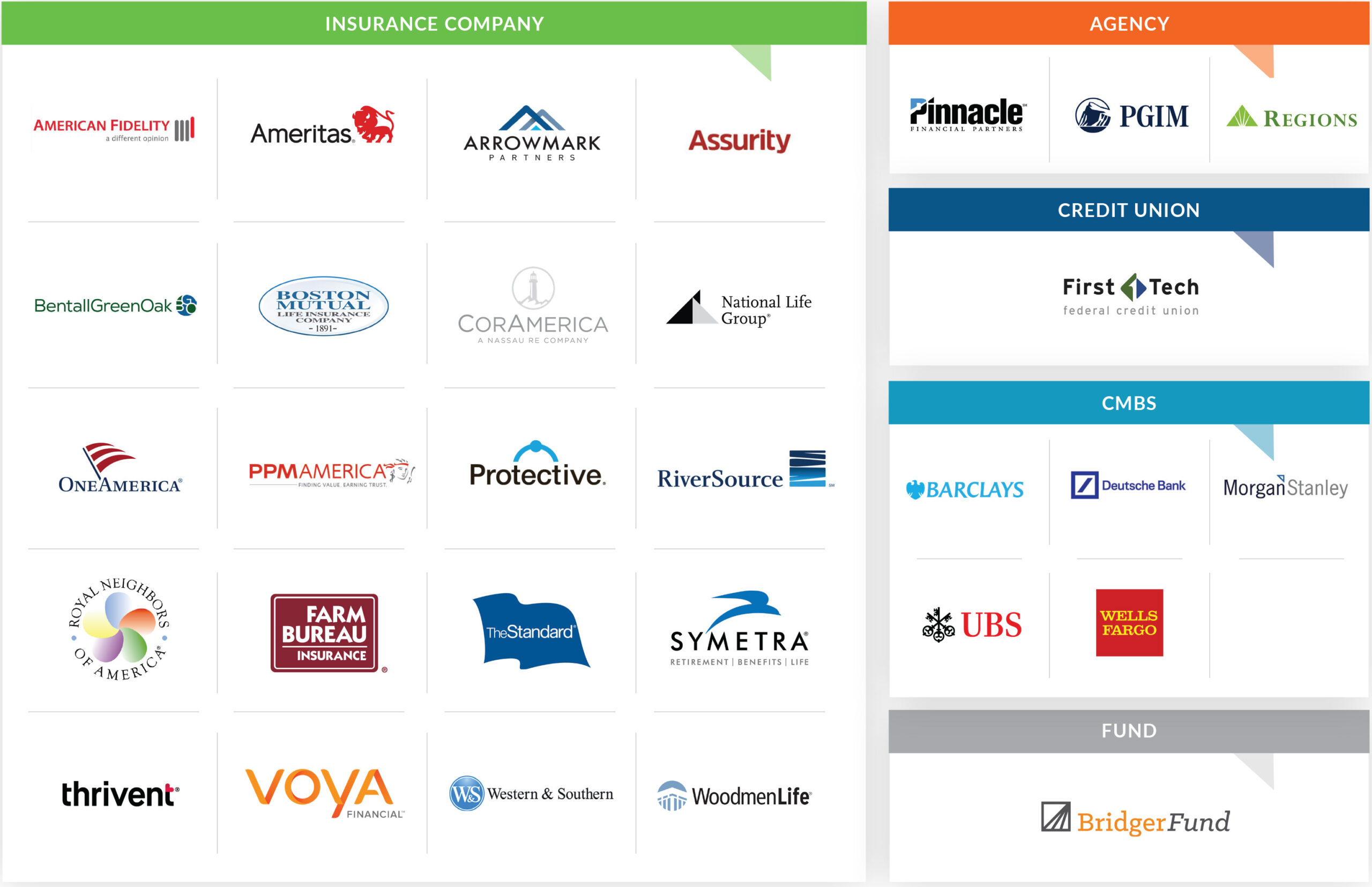

Slatt Capital has a correspondent relationship with almost 30 lenders including insurance companies, banks, credit unions, agencies, debt fund, and CMBS lenders. These partnerships allow us to offer capital resources for all commercial real estate property types ranging from $1-$250 million.

Life-of-Loan Service

Side-by-Side Every Step of the Way

Today’s lending landscape is complex and constantly evolving. Slatt Capital’s life-of-loan service means we can offer a single point of contact from origination to closing to servicing. We help clients navigate the nuances of each phase, acting as a valued advisor every step of the way.

1: Underwriting & Packaging

- Nationwide Market & Comp Database

- Lender Specific Underwriting

- Complete Borrower, Property & Market Packaging

2: Deal Placement

- Exclusive & Open Lender Platform

- Lender Database

- Company-Wide Deal Review

3: Close Deal

- Dedicated Team of Closers

- Tenant Specific Expertise

4: Service Loan

- Consistent Point of Contact

- Coordinate Lender Reporting

- Tax, Insurance & Escrow Management

5: Loan Maturity & Payoff

- Prepay & Payoff Estimation

- Early & Extended Payoff Structuring

Depth of Lender Access

Broad Outreach for Finding Our Clients the Right Fit

Slatt Capital represents more correspondent lenders than most other advisory firms. We also have access and relationships with all active open-market lenders and capital sources.

Long-Standing Lender Relationships

Bonds Built by Trust and a Track Record of Success

The Capital Markets business is personal by nature. Our firm was established in 1971, and over time has developed long-term relationships that are second to none. Some of our correspondent relationships date back over 50 years.