Refinancing Data and Primer

Thinking of refinancing your commercial property? This article might be for you.

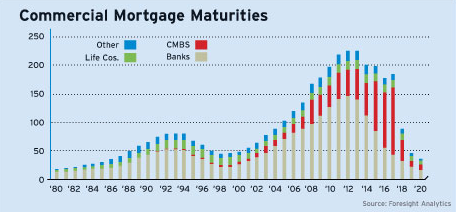

This graph (below) illustrates commercial mortgage maturities from 1980-2020. It’s a compelling picture—statistics show the tremendous concentration of loans requiring refinancing over the next few years. In particular there are a large number of CMBS loans maturing through 2017. These Conduit 1.0 loans were originated during the peak of the market in 2004-2007, and can be quite complicated to refinance.

Here’s an inside line on the refinancing process:

+ Think ahead. Initiate the process at least one year before your loan matures. It takes time for mortgage bankers to explore the myriad available options. Sound decisions and best case scenarios are often mutually exclusive at the last minute.

+ Look at the big picture. It may make sense to refinance early, despite prepayment penalties. A qualified mortgage banker will be able to asses the economics of a new long term fixed rate loan.

+ Come up with a strategy tailored to your unique criteria. Different types of loans have varying implications on your bottom line. Maximizing cash flow with longer amortizations and interest only creates a completely different road map than rapidly paying down a loan with a short amortization.

+ Dig up those documents. Typically we need a current rent roll, past three years of property level financial statements, and a personal financial statement from the borrower to asses what type of loan can be pursued.