Inflation: Expectation ≠ Reality

Judging by the news and the recent run-up in US Treasury yields, the market seems concerned that an ongoing recovery from the COVID-19 pandemic’s adverse effects on our economy may lead to runaway inflation. There may be reasons to feel such concerns may be overblown.

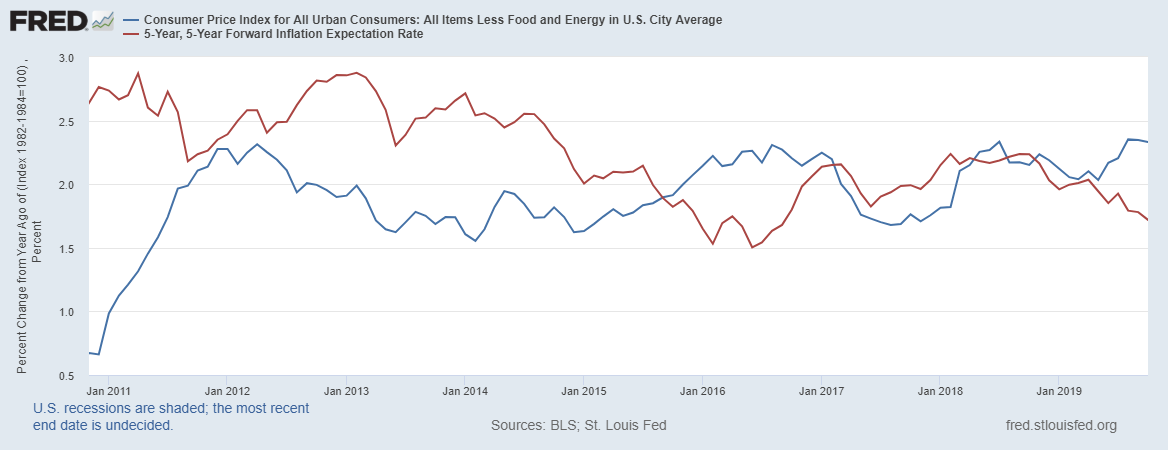

For example, below is a chart that plots the 10 years prior to the pandemic of actual core inflation (Consumer Price Index less food and energy) against each period’s inflation expectations. “Inflation expectation” per the St. Louis Fed is measured by the Treasury Yield curve changes over time. As you can see, there seems to be barely any correlation between expectations for inflation and what ends up being measurable in core CPI.

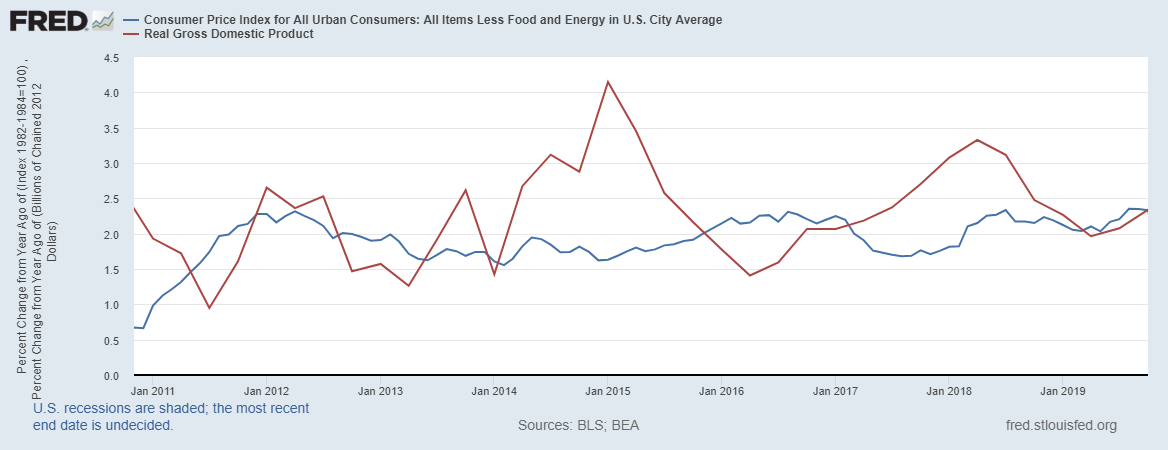

The next image shows the same core inflation YOY percentage measure plotted against YOY Real GDP during those same 10 years:

Traditionally, increases in GDP are expected to generate increases in inflation, but over the last decade, that has not necessarily happened. In fact, throughout the post-2008 recession recovery, the economy had grown steadily with no actual increase in inflation.

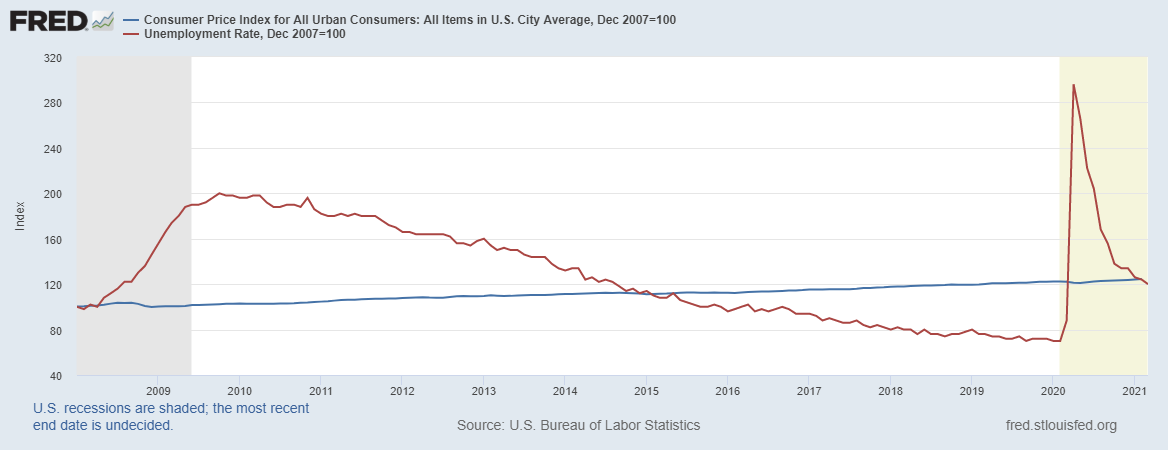

How about falling unemployment? As folks get their jobs back, surely inflation comes thereafter, right? Not necessarily; here is core inflation against unemployment indexed to Dec 2007 (pre-’08 recession). Permanent unemployment remains exceptionally high, with US jobless claims increasing over the last two weeks despite a solid rebounding in Q1.

So, while inflation is always a legitimate concern in a growing or recovering economy, the last decade of data has redefined how inflation might function in a modern economy. The reasons for this shift are for another post, but it just may be that any runaway inflation concerns may indeed be overblown.

Cody Charfauros

Principal / Managing Director

858.257.2110

codyc@slatt.com

Connect on LinkedIn