Real Estate Cap Rates in a Rising Rate Environment

A lot of chatter has surrounded the FOMC’s decision to finally raise their target Fed Fund’s rate range and its potential effect on the world of real estate investing. In our neck of the capital markets world, folks have been wondering how this change might affect commercial real estate and multi-family cap rates in the short and long-term outlooks. As several economists and CIOs have contended, Morgan Stanley’s thought on the topic puts it best, “the correlation between cap rates and Treasury rates turns out to be tenuous” which is, frankly, putting it lightly.

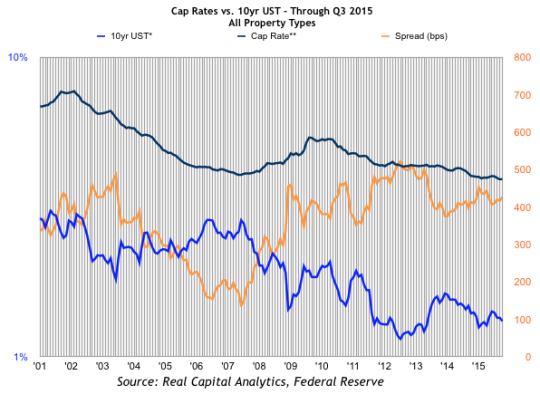

If anything, there is data to support a compression of cap rates in rising rate environments. For a period in 2004-2006 the 10yr UST rose over 100bps from around 3.8% to 5.1% while at the same time cap rates fell from 7.75% to 6.60% (Source: Real Capital Analytics, Federal Reserve). But, as anyone who lived through the previous cycle can attest, it was definitely not interest rate movement alone that accounted for the sharp run up in values.

So if interest rates—or more specifically Treasury yields—isn’t a good predictor of real estate valuation, what is? While others have written about many macroeconomic factors that correlate to changes in real estate cap rates, we’ve identified three key factors that most directly affect cap rates in our markets:

1. Demand- General Market Liquidity

Due to direct Fed interventions, the U.S. market is enjoying an immense excess of capital looking for a home. The supply and demand of real cash affects how equities and corporate and municipal bonds perform during a cycle, giving inflation-insulated investments like commercial real estate some real legs for those seeking risk-adjusted returns. With the Q1 2016 corporate bond outlook looking just as volatile as YE 2015, foreign and domestic capital is likely to continue to seek the relative safety of US real estate.

While banks will be forced to pay depositors slightly higher interest rates with the rising Fed Funds, it is unlikely their net interest margins (a key measure of a bank’s investment’s profitability) will increase in the short term with long-term rates remaining flat, counter to the fed’s “dot plot” expectations. Without a relief of the pressure on lenders to achieve yield in other areas, and despite the anticipated Dodd Frank regulations, funds will continue to be made available for a strong lending market. Because availability of real estate leverage is a contributor to more competition at the bidding table, this should further allow targeted cap rate compression in some sectors, all else remaining equal.

2. Demand- Investor Sentiment

While foreign investment continues to be this market’s bandwagon topic, all investors share a basic thirst for yield and/or wealth preservation in varying degrees. Hedge funds struggled in 2015, and even REIT performance was lackluster. Still, many argue real estate fundamentals remain generally sound and investor sentiment in U.S. assets are strong, “with 94% [of respondees] saying they will increase their investments here this year.”

Expect both private and institutional investors alike to begin departing from gateway markets, with increased activity in secondary areas outside of city centers with an outsized compression of cap rates in more suburban areas. Additionally, some of our foreign investor clients and brokers that concentrate in this space seem to be starting to shift their investing perimeters to smaller assets in a search to diversify portfolios.

3. Supply- Existing Assets vs. New Construction

While material costs in construction have fallen, labor costs have skyrocketed post-recession in nearly all markets, forcing developers to concentrate solely on Class A builds. Take multifamily as an example; new multifamily starts have been largely high-quality market-rate quality assets, and only since mid-2015 have new deliveries started to outstrip absorption. So while there had been huge compression on multifamily across the board outstripping pre-recession peaks, additional downward compression on Class-A multifamily in major MSAs may continue to slow in 2016 as new units come online and Class-A vacancy begins to tick back up. This will be particularly prominent in cities and states that are developer-friendly, though construction lending is still relatively scant compared to pre-recession levels, and will likely continue to be challenging.

As more investors look for potential rent increases as a key investment criterion, we also expect to see a greater demand for investment in decently-located existing B and C quality assets in all markets along with a corresponding continued downward pressure on real estate cap rates there. Similar effects can be seen in other asset classes, though suburban office may have headwinds in many markets.