Q3 Lender Segment Market Update

In an effort to keep our customers up to date with current market trends, the following is an update for each sector of the lending market.

Insurance Companies

As we move deep into the 3rd quarter of the year, most insurance companies have plenty of allocated funds left to lend in 2020. Most insurance companies are not only looking at historical operating history when assessing new lending opportunities, and they are also taking a hard look at the current rent schedule. They want to make sure all tenants are in occupancy and paying rent. Current pricing on typical 10-year insurance company debt averages between 2.50–4.00%. It is crucial to work with an established mortgage banking firm, like Slatt Capital, to assure certainty of execution and life-of-loan service. Deep relationships established over multiple decades of transacting helps ensure smooth closings.

Banks/Credit Unions

For rates at the low end of the range, lenders are looking for lower leverage high-quality assets in infill locations. Most banks are still actively lending, although they are using much more conservative underwriting requirements. Construction and bridge bank loans are much harder to come by than loans on stabilized properties; however, both are still getting done. This market remains fluid but selective. The market for bank and credit union financing is quite liquid overall for a recessionary environment.

Agencies

Freddie Mac and Fannie Mae have been lending throughout this COVID-19 pandemic. The biggest changes for agency debt involve requiring principal and interest reserves, tax and insurance reserves, and replacement reserves for many loans. Interest rates in this sector are very aggressive and typically in the 2.5%–3.5% range.

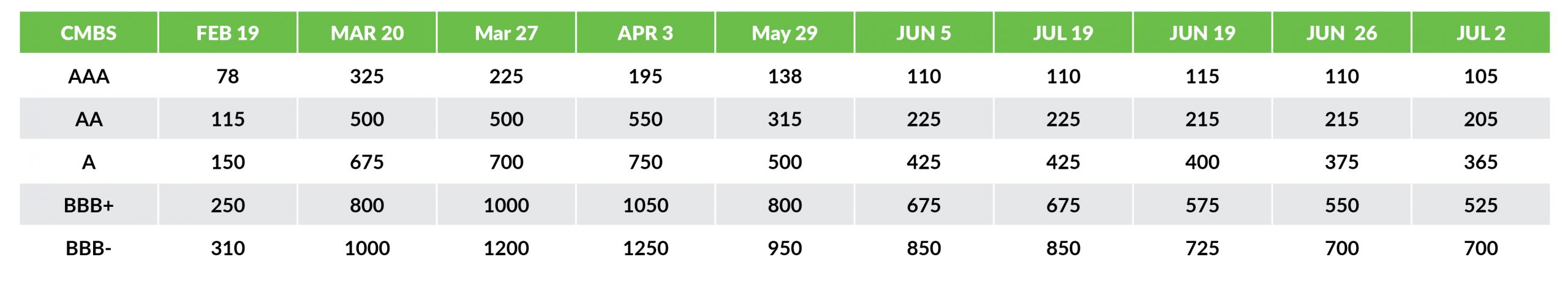

CMBS

The CMBS market was stalled out for several weeks in March and April because the market to securitize loans was shut down in early March. Since then, the CMBS market has made a resurgence. CMBS lenders are actively originating new loans and the securitization market has become very liquid with Federal Government stepping in to purchase CMBS and other fixed-income debt. The Fed’s action to liquify the market started in April. The chart below, provided by Morgan Stanley, shows how the different tranches of CMBS debt have priced from mid-February until early this month. New CMBS loans are currently pricing in the 2.50-4.0% range.