Average Interest Rates & LTV

May 7, 2020

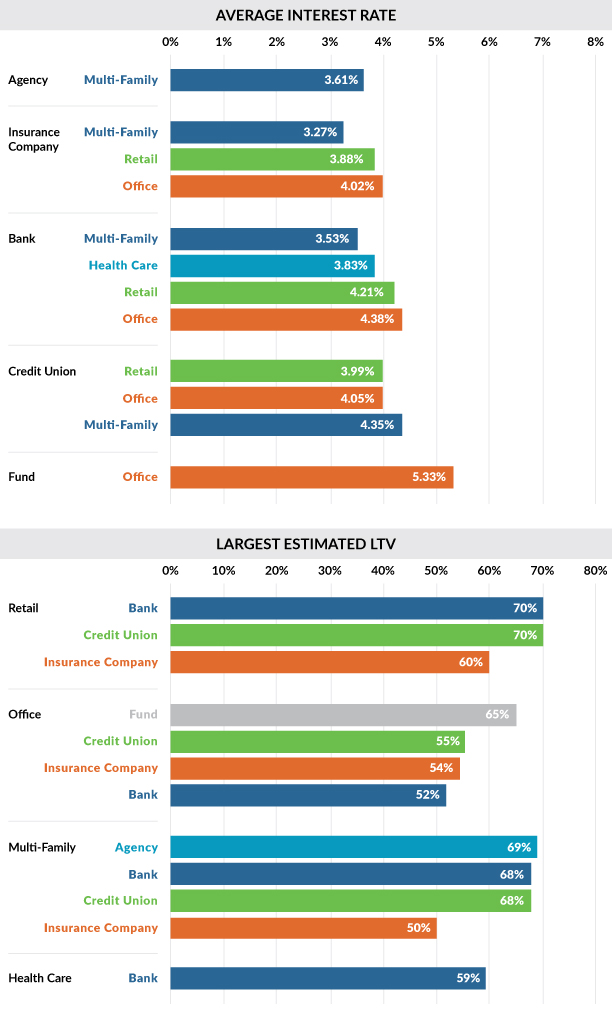

Slatt Capital understands the importance of open communication during uncertain times and how vital information sharing is amongst our clients and industry partners. As part of these efforts, we’ve provided a summary of Average Interest Rates and Loan-To-Value (LTV) ratios across the different property and lender types. This information is based on financing quotes received in the last 30 days, across all Slatt Capital offices:

- Multi-Family and Healthcare properties are achieving the best pricing on rates. Retail and Office are still receiving competitive pricing but generally 50-70bps higher than more sought-after lender property types.

- Best pricing is also available on Industrial properties (both single and multi-tenant), but recent loan requests have been focused on Retail, Office, and Multi-Family properties.

- The most competitive pricing has been from Insurance Companies, followed by Banks, Credit Unions, then the Private/Fund market. Agency lenders have pricing on-par with Insurance Companies and Banks but are solely focused on Multi-Family properties.

- Lender underwriting has become more conservative but leverage requests up to 65-70% LTV is still achievable. We expect this to hold or even increase as CMBS lenders return to the market.