2020 Interest Rate Recap

Here’s a recap of the 2020 interest rate movement:

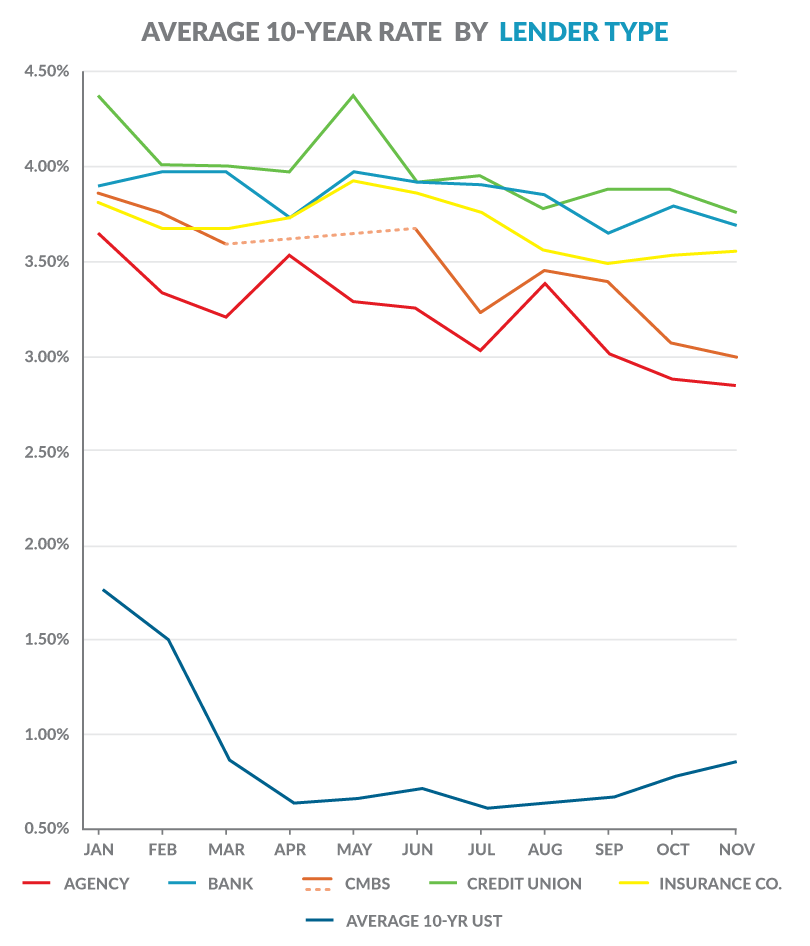

It’s hard to believe that 2020, the year that felt like a decade, is nearly over but here we are just weeks away from ringing in a socially-distanced New Year. With such tumultuous ups and downs over the year, Slatt Capital thought it would be beneficial to share some insider knowledge on just how crazy the interest rate movement has been during the COVID-19 pandemic. The following chart is based on quotes received across all Slatt Capital offices, across all property types, for 10-year fixed mortgage requests.

- Rates were steadily dropping across all lender types as we came through Q1 2020. Lenders were flush with cash and looking for every opportunity to lend as interest rates continued towards new historic lows.

- The rapid COVID-19 outbreaks of spring and subsequent shut-downs of March and April severely shook the lending market. Many lenders instituted new floor rates, increased spread margins (to counter rapidly dropping US Treasury rates), or simply halted all lending activities. All lenders took a much finer comb to any new loan requests and some properties like Hospitality, Retail, Office and Special-Use became nearly impossible to finance with traditional lenders (and many challenges still remain today especially with Hospitality and Retail/Office properties with tenants affected by COVID).

- Some could say the CMBS (Conduit) market saw the most dramatic changes as this segment was basically out of the market in the middle of the year but has returned as a low price leader (depending on the specific loan request).

- All lender types are now quoting rates at levels below where they were at the start of 2020. Part of this is due to spread compression but also attributed to the massive decline in US Treasury rates over the year.

The bottom line is lender activity has returned to “normal” levels as we saw in Q1, albeit with different property appetites and overall stricter underwriting requirements. It looks like low rates are here to stay for the immediate future and we at Slatt Capital firmly believe 2021 will bring tremendous financing opportunities for those looking to secure low rates on stabilized properties.

Andrew MacLeod

Vice President

D: 650.931.9017

andrewm@slatt.com

Connect on LinkedIn