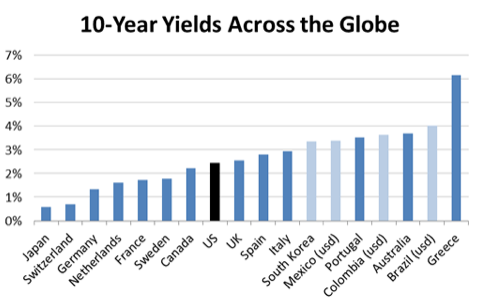

10-Year Yields Across the Globe

Treasuries are again being actively purchased in significant amounts, keeping interest rates at record lows and offsetting reduced purchases by the Fed. According to the Wall Street Journal, there are a couple of reasons for these low rates and purchases:

+ Overseas buyers are purchasing Treasuries to gather dollars and help weaken their currencies as a way to boost exports.

+ Financial institutions are stocking up on Treasuries to meet regulations requiring them to hold more capital. US Treasuries held by commercial banks and savings institutions are the highest since 1995.

+ US Treasuries yield more than comparable securities. For example, Japanese 10-year government bonds recently yielded 0.6%, while German bonds yielded 1.3%, compared with recent Treasury rates at 2.6% and 3% at the end of 2013.

+ US Treasuries currently yield just slightly less than economically weaker courtiers of Spain (2.65%) and Italy (2.77%)

+ US is issuing less debt because of higher tax receipts from an improving economy.

Another study by the Vanguard Investment Advisory firm shows that that our current Treasury 10-year yield is in the middle of 10-year yields across the globe. Our current 10-year yield is higher than those found on many developed markets’ bonds, including France and Canada. Yields in emerging market countries aren’t much higher either, with bonds from countries like Brazil, Mexico and South Korea sporting yields below 4%.

by Rich Davidson